No Crash Ahead: The Bay Area’s Housing Market Is Solid

Learn why this market isn’t following crash predictions.

With discussions about the economy and potential concerns over a housing market crash, it’s understandable if you’re feeling uncertain. But here’s some good news: both nationally and in the San Francisco Bay Area, the housing market is in a much stronger position than it was in 2008, and there’s no crash on the horizon.

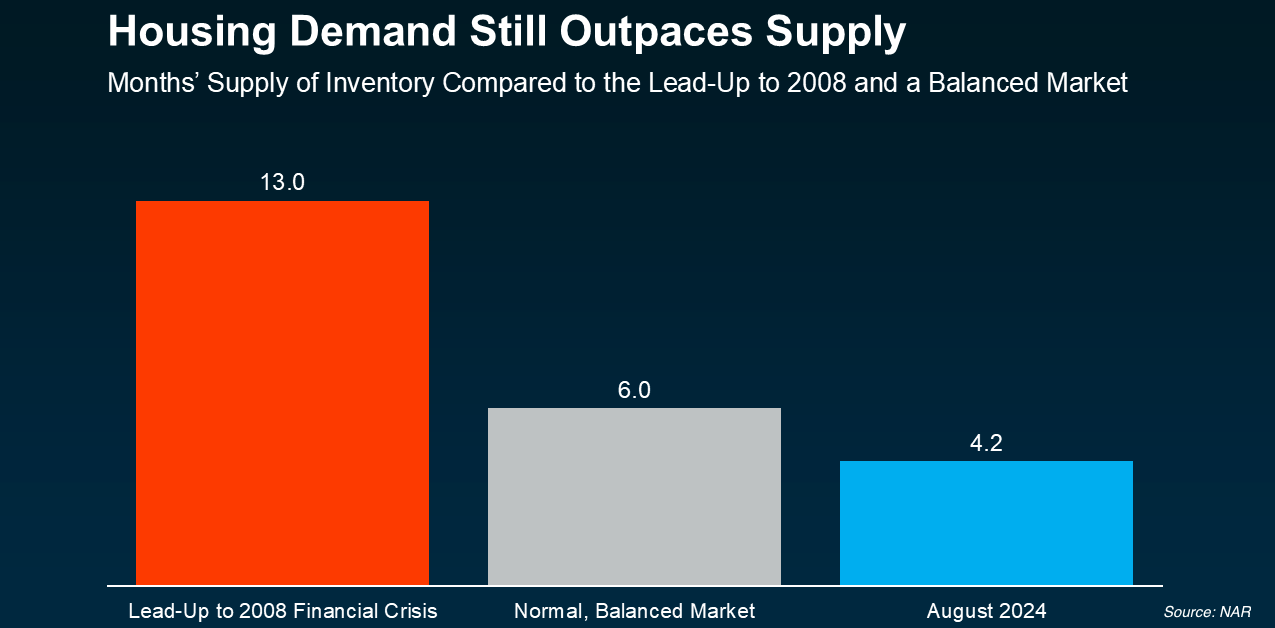

Housing market crashes typically happen when demand drops or there’s an oversupply of homes. Thankfully, neither of these factors are affecting the Bay Area today. Here’s why:

1. Demand Outpaces Supply

Nationally, there’s only a 4.2-month supply of homes, far lower than the 13-month oversupply before the 2008 crash. The San Francisco Bay Area real estate market faces even tighter inventory across counties. For example:

- Alameda County: The median home price as of August 2024 was $1.07 million, with homes selling within 36-47 days.

- San Mateo County: San Mateo’s median home price stands at $1.7 million, with homes averaging just 30 days on the market.

- Napa County: The median home price is around $1.25 million, with homes typically on the market for 100 days.

- Sonoma County: Sonoma County’s median home price is $1.19 million, and homes sell in about 91 days.

- Marin County: Marin has one of the higher median prices in the region at $1.3 million, with properties staying on the market for about 84 days.

- Contra Costa County: With a median home price of $845,000, Contra Costa homes are selling in about 47 days.

- Santa Clara County: The median home price in Santa Clara is $1.45 million, with homes generally selling within 36-45 days.

Even though interest rates have risen, they are expected to decrease in 2024, which should spur more activity from both buyers and sellers. Historically, real estate transactions slow in the months leading up to an election but rebound afterward, a pattern we expect to see in the Bay Area.

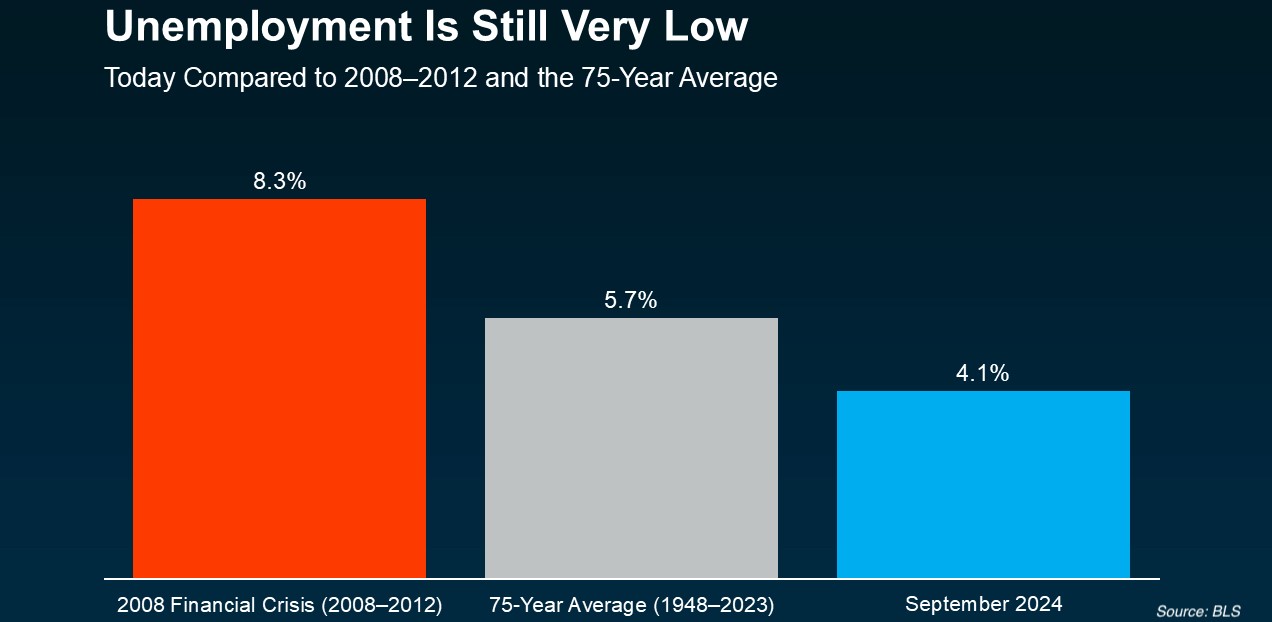

2. Low Unemployment Supports Stability

National unemployment rates remain low at 4.1%, and the Bay Area enjoys similar stability due to its strong tech-driven economy. With high-paying jobs, most Bay Area homebuyers can afford to stay in the market, which helps support home prices. This economic strength has kept foreclosures low, further reducing the chances of a housing market crash.

The Bay Area Housing Market: No Crash Predicted!

The San Francisco Bay Area’s housing market remains strong, with demand continuing to outpace supply. As interest rates drop post-election, both buyer and seller activity are expected to rise. If you’re considering buying or selling in this competitive market, connect with a local expert from our Bay Area Modern Team to guide you through your real estate journey in the Bay Area.

Contact us for experienced representation when buying or selling property in the Bay Area.