Thinking about selling your home in the Bay Area – whether you’re in San Francisco, Marin, the East Bay, or up in Wine Country? If so, you’re probably aiming for a smooth, profitable sale. Who wouldn’t? But here’s the thing: a lot of sellers right now are overshooting on price, and it’s costing them.

Yes, demand is still strong in many parts of the Bay. But the market has shifted. That frenzied, bidding-war-every-weekend vibe we saw during the pandemic? It’s cooled. Inventory is climbing in some counties, especially in the East Bay and South Bay. Buyers have more choices. And they’re taking their time.

That means sellers need to adapt—especially when it comes to pricing.

Price Cuts Are Creeping Up – But They’re Usually Avoidable

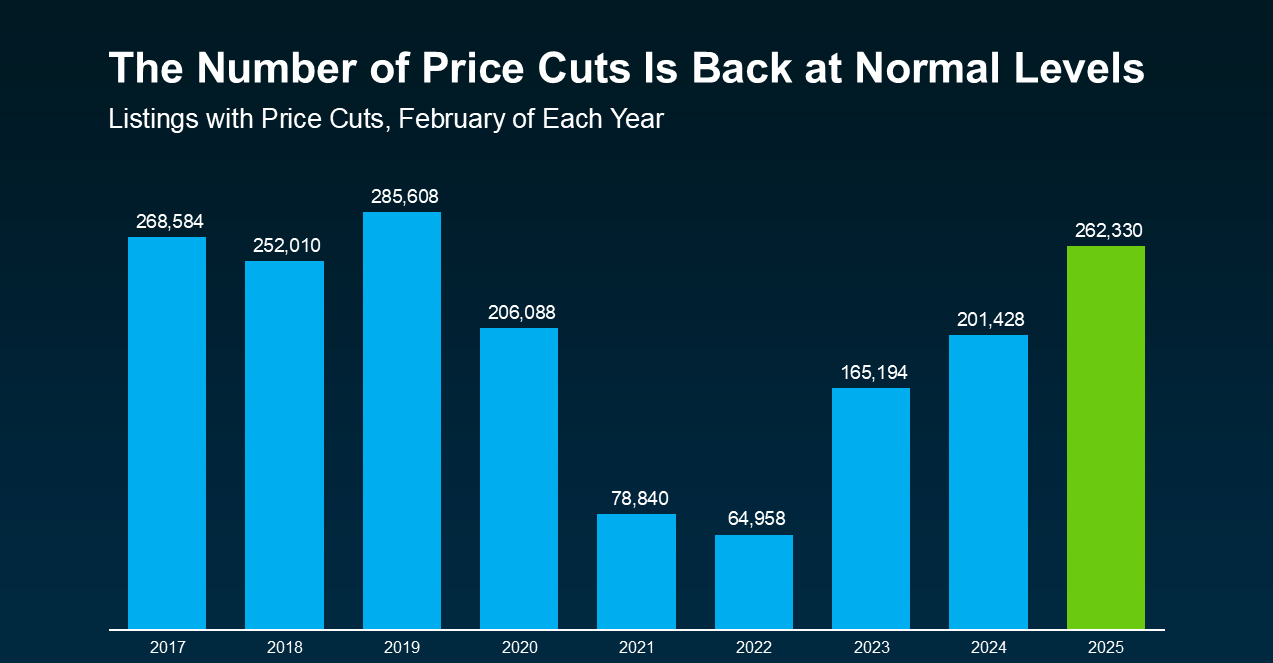

According to Realtor.com, more homes saw price reductions this February than any February since 2019. That was the last “normal” year before everything changed, so in some ways, we’re just seeing the market return to a healthier pace. But not every seller has gotten the memo.

Here’s what’s happening: homes hit the market with aspirational pricing… and they sit. Then come the price cuts. And unfortunately, by the time those happen, the best momentum is already gone.

The result? Sellers often end up walking away with less than if they had just priced it correctly from the beginning.

So, How Do You Price It Right in Today’s Bay Area Market?

This is where having a savvy, local expert in your corner really matters. At Bay Area Modern Real Estate, we don’t price based on what a neighbor got two years ago or what you “hope” to make. We rely on:

- Sold comps in your specific neighborhood—not just list prices

- Micro-market trends, block by block and zip by zip (because let’s face it, a condo in SoMa is a totally different game than a rancher in Walnut Creek)

- Current buyer behavior, including how homes in your price range are performing right now

In certain areas—like parts of San Mateo County or Alameda—we may even suggest pricing slightly under market value to drive interest and create a sense of urgency. When you’re competing with 10 other homes in the same price band, this strategy can work wonders.

Why Overpricing Backfires in the Bay Area

Some sellers say, “Let’s just try a high price and see what happens.” We get the temptation. But it’s risky—especially here.

Bay Area buyers are sharp. Whether they’re longtime locals or transplants from L.A. , Chicago or New York, they’re doing their homework. They’re looking at comps. They’re plugged into Redfin and Zillow alerts. If a home is overpriced, they know it.

Here’s what usually happens:

- The home gets skipped over entirely—Buyers filter it out because it doesn’t seem competitive.

- It lingers on the market—Once that happens, the home starts to feel stale.

- Price drops follow—And the offers that come in? Often lower than expected.

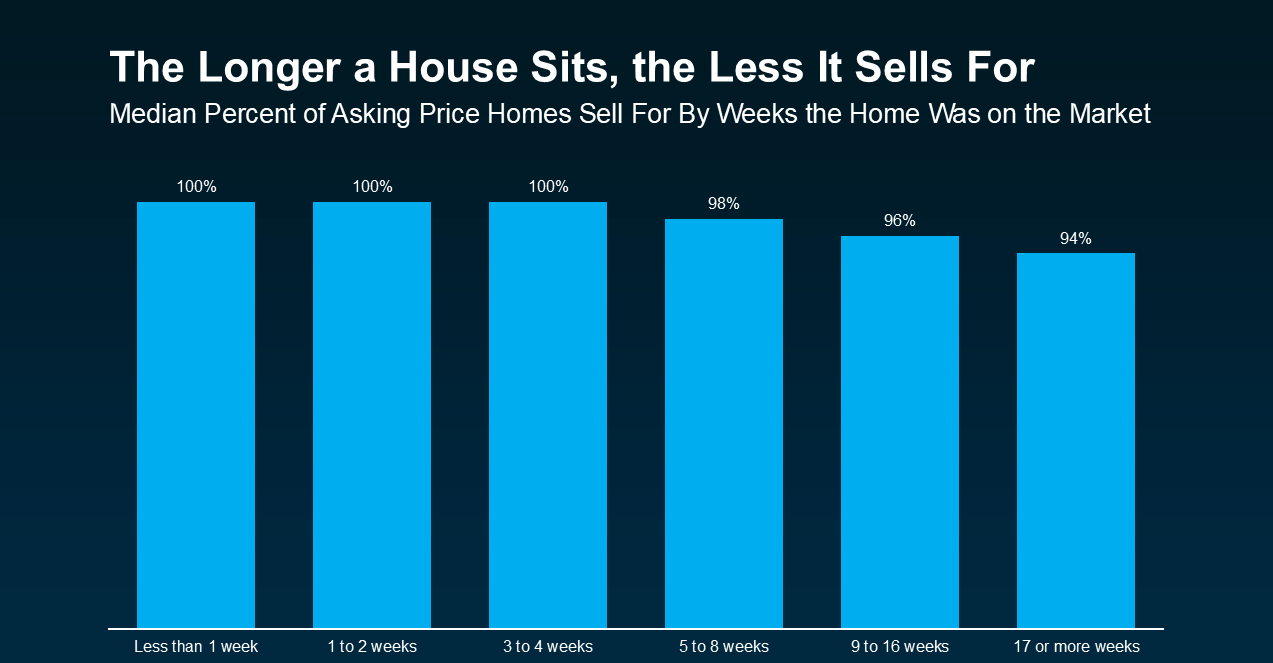

Want proof? Check out the chart below from the National Association of Realtors (NAR). It’s pretty telling:

What the numbers show is this: homes that sell within the first four weeks often go for full asking – or more. That aligns with what we see locally too. In hot pockets like Rockridge, Mill Valley, Petaluma, or Redwood City, a home priced correctly can create real buzz and even spark competition.

But when it’s priced too high from the start? The excitement fizzles. Days on market drag on, interest fades, and price reductions become inevitable. And with each week that passes, buyers start asking themselves: What’s wrong with it?

The Bottom Line for Bay Area Sellers

Whether you’re in the hills of Berkeley, a cul-de-sac in San Rafael, or a condo in downtown San Jose – pricing your home right from the beginning is your best chance at a successful, stress-free sale. It’s not just about listing it – it’s about launching it with strategy and purpose.

If you’re ready to sell, let’s talk. We’ll give you an honest, data-driven pricing recommendation tailored to your specific home, neighborhood, and market segment.

Want to sell smart? Reach out to your local Bay Area real estate experts at Bay Area Modern Real Estate. We live here. We work here. And we know this market inside and out.