Form 1099-H was last used for tax year 2021 and was issued to people who received advance payments of the health coverage tax credit (HCTC) to help cover health insurance costs. Let’s break down exactly what this form was all about and how it impacted your income tax return.

At a glance:

- Form 1099-H was used to report advanced payments for the health coverage tax credit or HCTC.

- The HCTC expired after tax year 2021, so you will not receive it for tax year 2024.

What is a 1099-H form?

The 1099-H form was an Internal Revenue Service (IRS) form that reported the total amount of advance payments received for the health coverage tax credit. The HCTC expired on Dec. 31, 2021, but it was designed to help individuals and their family members pay for health insurance premiums if they were receiving benefits like trade adjustment assistance (TAA), alternative TAA, reemployment TAA, or payments from the Pension Benefit Guaranty Corporation (PBGC).

IRS Form 1099-H example

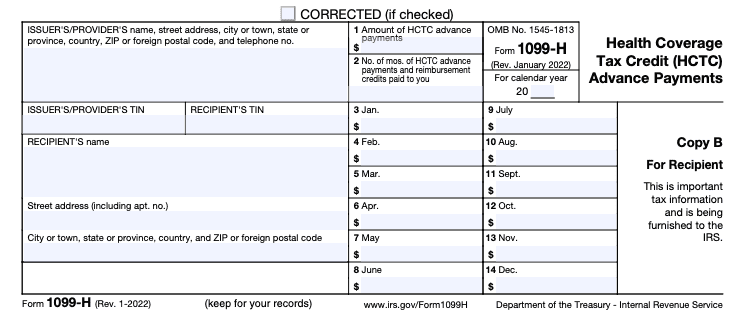

Below is an example of what Form 1099-H looked like:

This tax document contains contact information for the issuer/payer (the health insurance company), including their name, address, and taxpayer identification number (TIN). You’ll also see information for the payee (you) and your TIN, often your Social Security number (SSN).

- Box 1: Amount of HCTC advance payments – This lists the total amount of advance payments made to your health insurer under the HCTC program. You needed this info when you filed your tax return to determine how much you benefited from the credit.

- Box 2: No. of mos. of HCTC advance payments and reimbursement credits paid to you – This shows the number of months you received HCTC payments.

- Boxes 3-14 – These boxes show the HCTC advance payment amount you received in each month (the total of these boxes equal the amount in Box 1).

Form 1099-H instructions

- Check for accuracy: As a tax filer, it’s important to always check the numbers on your tax forms to ensure accuracy. If you notice something off, contact the form’s issuer right away.

- Report on your tax return: If you received Form 1099-H, you would have reported it using Form 8885. If you e-filed with TaxAct®, our software helped walk you through the process step-by-step.

- Keep Form 1099-H: Always hang onto your tax forms for at least three years in case the IRS needs to verify something.

FAQs about Form 1099-H

How do I report a 1099-H?

To report your HCTC payments, you would include the information from Form 1099-H on Form 8885 when filing your tax return. You did not have to attach Form 1099-H to your federal tax return.

How can I get a 1099-H form?

Since the 1099-H form is no longer used, you won’t receive it for tax years beyond 2021. However, if you need a copy from 2021 or earlier, you may still be able to find it through your insurance coverage provider.

How to report Form 1099-H with TaxAct

Even though Form 1099-H has been retired, it’s still important to file a federal income tax return, especially if you might qualify for a tax refund. For tax years when the form was still relevant, TaxAct made it easy to report health coverage tax credit information.

To claim the HCTC for 2021, when you filed in 2022, you had to file Form 8885, Health Coverage Tax Credit, and attach documentation that showed you were an eligible individual for the HCTC and that the premiums claimed for your 2021 coverage were paid. If you electronically filed your federal income tax return, you had to submit the required documents with Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return.

To access Form 8453 in the TaxAct program:

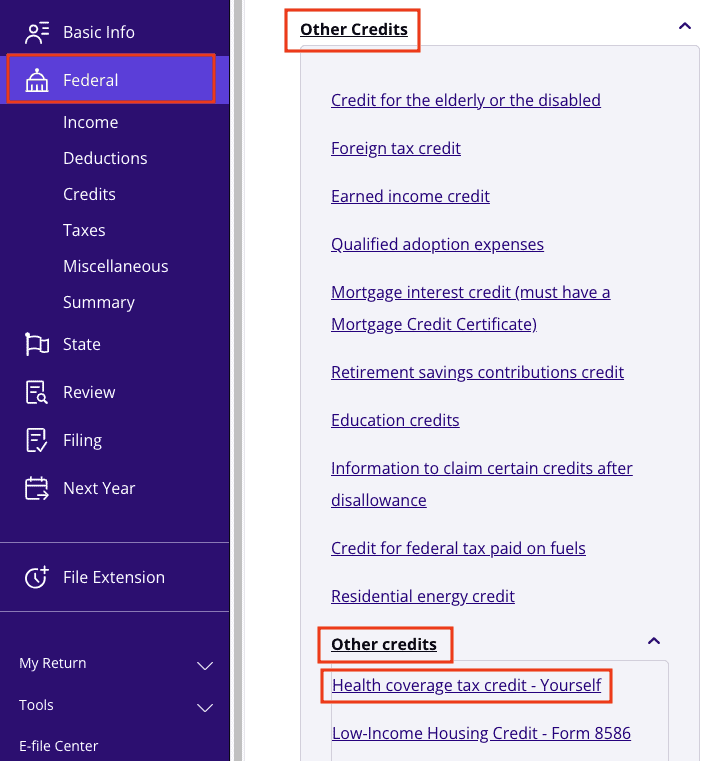

- From within your 2021 TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Other Credits dropdown, click the second Other credits dropdown that appears, then click Health coverage tax credit – [Name].

3. Continue with the interview process to enter your information.

The bottom line

Form 1099-H might be a thing of the past, but understanding how it worked is still valuable. Remember, if you ever need help navigating any other tax forms — perhaps another information return like 1099-DIV, 1099-INT, or 1099-NEC — TaxAct has your back. We make the tax filing process straightforward and easy so you can get back to doing the things you’d rather be doing.