Should you buy a home now or should you wait? That’s a big question on many people’s minds today. And while what timing is right for you will depend on a lot of other personal factors, here’s something you may not have considered.

If you’re able to buy at today’s rates and prices, it may be better to focus on time in the market, rather than timing the market.

The Downside of Trying To Time the Market

Trying to time the market isn’t a good strategy because things can change. Here’s an example. For the better part of this year, projections have said mortgage rates will come down. And while experts agree that’s still what’s ahead, shifts in various market and economic factors have pushed back the timing of when that’ll happen. Here’s how that’s impacted homebuyers who’ve been sitting on the sidelines. As U.S. News says:

“Those who put off buying a home during the past few years as they were holding out for lower mortgage rates have been left out of the market . . . mortgage rates have stayed higher for longer than previously expected, keeping monthly housing payments elevated. In other words, affordability didn’t improve for those who chose to wait.”

This is why timing the market may not pay off if you’re ready and able to buy now.

The Proof Is in the Pudding: How Homeowners Benefit from Rising Home Prices

Delaying your plans also means missing out on the equity you’d gain if you went ahead with your purchase today. And the potential equity gains that are at stake may surprise you.

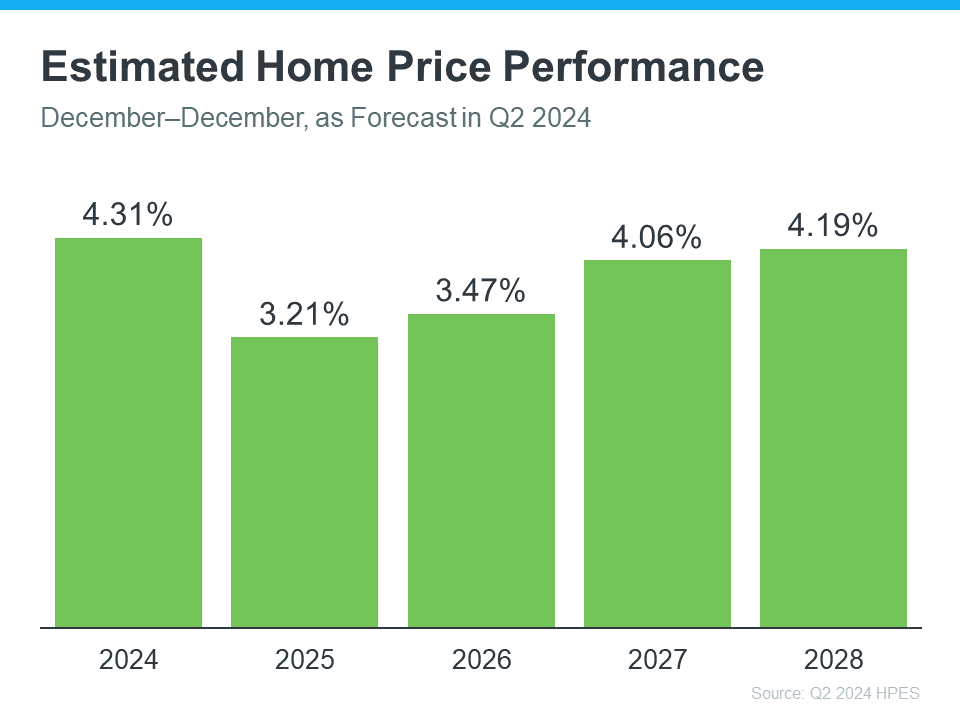

Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts are projecting home prices will continue to rise through at least 2028 (see the graph below):

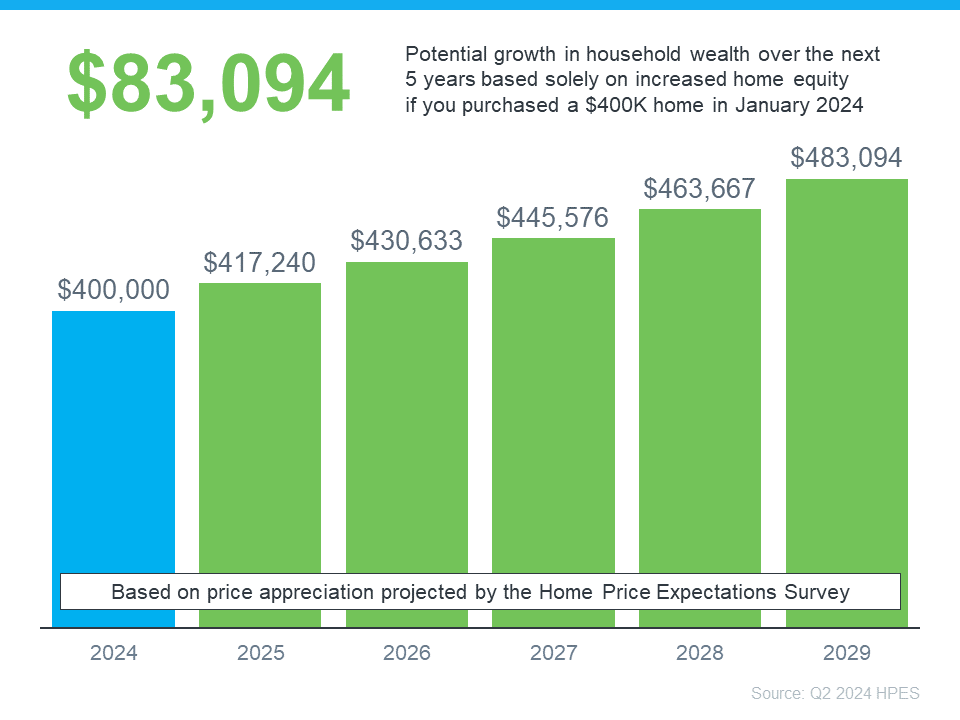

To give these numbers context, let’s take a look at a breakdown of what you stand to gain once you buy. The graph below uses a typical home’s value to show how a home could appreciate over the next few years using those HPES projections:

In this example, let’s say you went ahead and bought a $400,000 home at the beginning of this year. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number.

This data helps paint the picture of why time in the market really matters.

The Advice You Need To Hear If You’re Ready and Able To Buy Now

Right now, you may be focused on what’s happening with mortgage rates and how those impact your monthly payment, but don’t forget to factor in home prices.

Prices are expected to continue climbing, just at a more moderate pace. And while a moderate rise in prices may not be fun for you now, once you own a home, that growth will be a huge perk. That’s the time in the market piece.

Sure, you could try timing the market, but the equity you’ll be missing out on in the meantime is something to seriously consider. If you’re ready and able to buy now, you have to decide: is it really worth waiting?

Rather than focusing on timing the market. It’s better to have time in the market.

As U.S. News Real Estate sums up:

“There’s never a one-size-fits-all answer to whether now is the right time to buy a home. . . . There’s also no way to predict precisely what the market will do in the near future . . . Perfectly timing the market shouldn’t be the goal. This decision should be determined by your personal needs, financial means and the time you have to find the right home.”

If you’re debating whether to buy now or wait, remember it’s time in the market, not timing the market. And if you want to get the ball rolling and set yourself up for those big equity gains, let’s connect to make it happen.

Contact us for experienced representation when buying or selling property in the Bay Area.