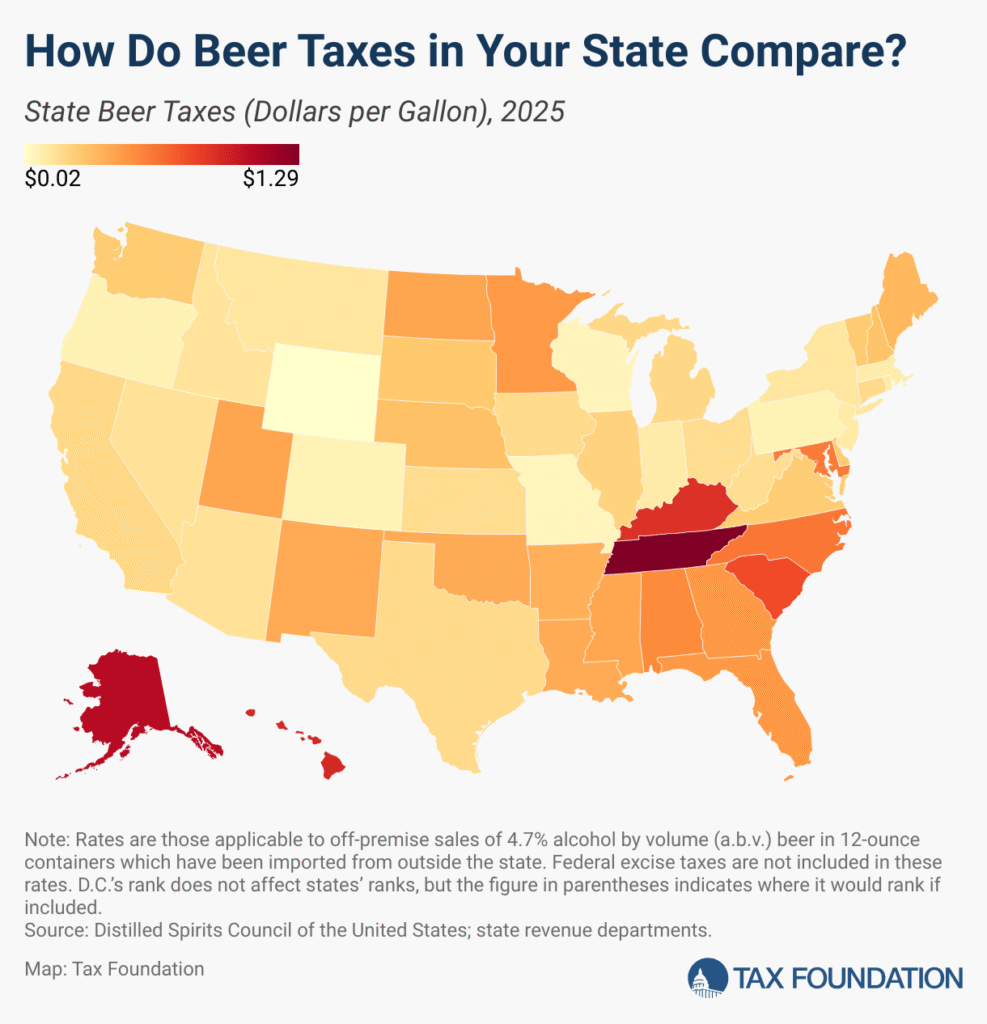

2025 Notable Changes

- Connecticut reduced the tax rate on beer from $0.24 per gallon to $0.19 per gallon.

- Kentucky reduced the tax rate on beer from $0.93 per gallon to $0.89 per gallon.

- Arkansas increased the tax rate on beer from $0.35 per gallon to $0.38 per gallon.

- North Dakota increased the tax rate on beer from $0.40 per gallon to $0.43 per gallon.

- Utah increased the tax rate on beer from $0.41 per gallon to $0.43 per gallon.

The per gallon rate shown reflects the tax applicable on an off-premises sale of a 4.7 percent alcohol by volume (ABV) beer in a 12-ounce container. In 16 states, the tax rate varies based on alcohol content, place of production, size of container, or place of purchase.

For instance, Virginia has a different tax per bottle for containers up to 7 ounces, up to 12 ounces, and greater than 12 ounces. Idaho levies triple the tax if the beer is over 5 percent ABV, which statutorily is taxed the same as wine at $0.45 per gallon rather than $0.15 per gallon.

Many states also generate revenue via licensing fees and permits from beer distributors and retailers. Other states manipulate the price of beer—and thus the minimum amount of ad valorem tax collected—by establishing statewide minimum price levels.

Federal and state taxes on beer are often levied on the manufacturer, wholesaler, or retailer, which are not explicitly broken out into a separate line item on a bill or receipt like a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

. Instead, the tax burden is baked into the final retail price. Thus, consumers may not be cognizant of just how much they are paying in taxes on their drink of choice.

Beer exists within a complex taxation and regulatory landscape. Alcohol is generally taxed using a categorical system that treats beer, wine, and spirits differently even after adjusting for alcohol content. Modernizing the arcane categorical system by instead taxing according to actual alcohol content would make the broader alcohol tax system simpler and more neutral. Understanding the tax framework is crucial for both consumers and policymakers as the industry and the policy evolve for one of America’s most cherished beverages.