The Harris campaign has mostly proposed increasing taxes on businesses and high-income earners. However, the campaign’s new policy document adds a few proposals to reduce taxes on businesses, including, notably, America Forward taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

credits. Directionally, the change is laudable. But drawing arbitrary lines around what investment is and is not eligible for better tax treatment is not a true solution for underinvestment. There are better, simpler alternatives for increasing business investment.

The Biden administration’s two major legislative achievements focus on a few specific industries: the CHIPS and Science Act focuses on semiconductors, while the Inflation Reduction Act (IRA) focuses on green energy production and electric vehicles. Harris’s new America Forward tax credits would be available for a broader suite of economic activity, targeting a mix of “emerging technologies” including AI, aerospace, biotech, and data centers, as well as modernizing “traditional industries,” with iron and steel manufacturing receiving specific mention.

The campaign makes the case for the policy on both economic and national security grounds, drawing parallels to the CHIPS Act. The exact design of the tax credits is not clear (for instance, they could be based on a percentage of investment or of production), and the campaign has suggested they would include additional incentives or requirements related to investment location and use of unionized labor. The campaign has estimated the credits would cost roughly $100 billion.

Investment matters across the whole US economy, not just in semiconductors or clean energy. Under their current design, Harris’s policy raises a lot of questions.

Which industries make the cut? Aerospace and semiconductor manufacturing are both advanced industries, with possible critical security aspects, but what about medical devices? Why should iron and steel be included, but food products, petroleum products, or basic chemicals not be? They also hold plausible claims to fundamental security needs. This is to say nothing of non-manufacturing industries like telecommunications or warehousing, which both serve important roles in infrastructure and supply chains, or high value-added professional services industries.

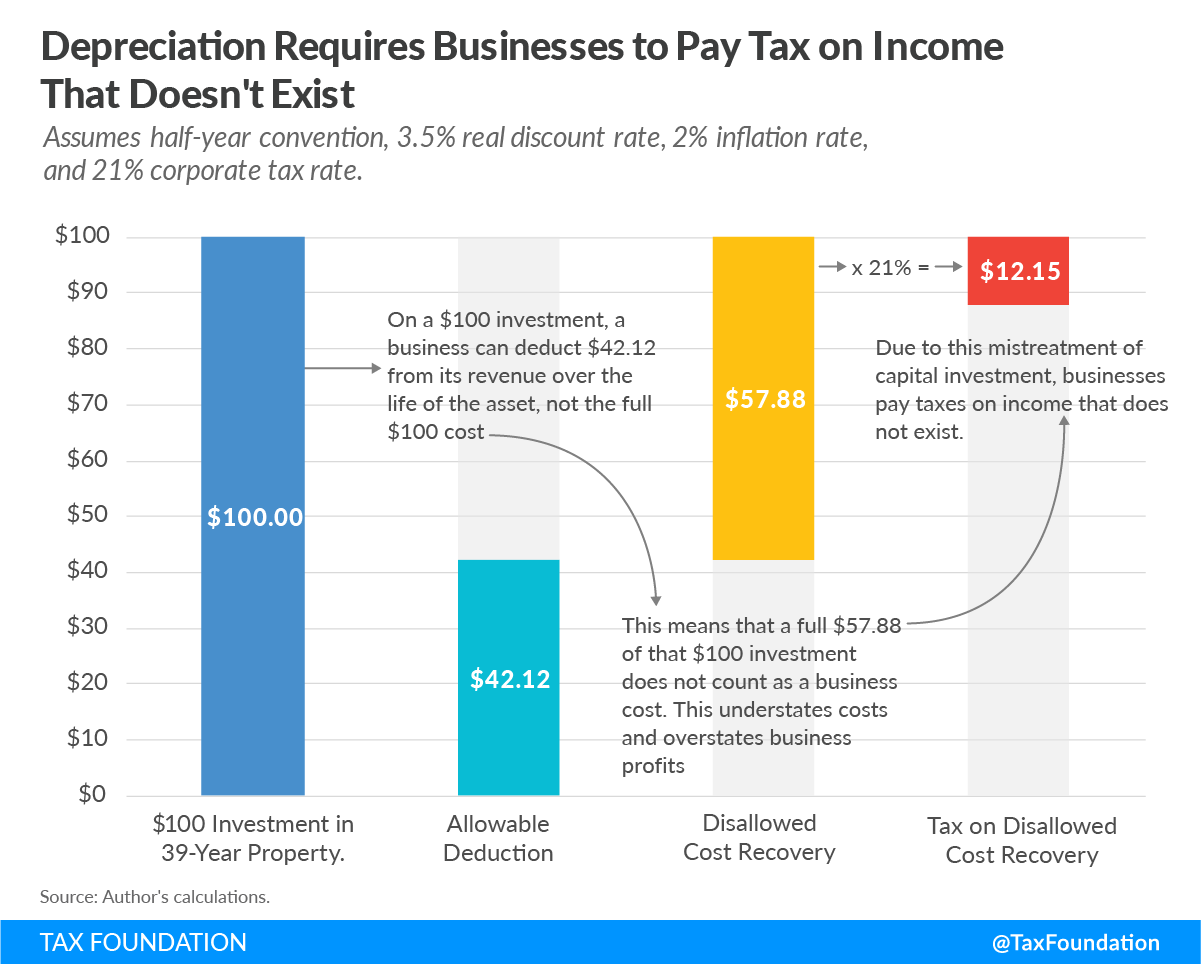

That is a lot of important industries, right? And we have policies available to us that can incentivize investment in all of them at the same time. Current law forces companies to spread deductions for capital investment out over the course of several years (depending on the type of investment). This creates a tax penalty for capital investment.

The solution: allow full and immediate deductibility of capital investment.

While a neutral policy, it would indirectly help exactly the sort of businesses the Harris campaign is interested in helping. Know what semiconductor fabs need to invest a lot in? Equipment. As Brian Potter of Construction Physics recently wrote, advanced semiconductor fabs can cost up to $20 billion, with between 70 and 80 percent of those costs being extremely specialized and complex equipment. ASML’s most advanced chip-making machines, for instance, cost upwards of $300 million each. While both a potato chip manufacturer and a computer chip manufacturer should both be able to deduct the cost of their equipment purchases, the latter is going to benefit a lot more from that ability.

It is a similar story on research and development (R&D) investment. Letting firms fully deduct R&D costs benefits any firm that wants to invest in technology or product innovation. However, some industries are more R&D-intensive than others. Re-establishing full and immediate deductibility of R&D expenses would accordingly benefit machinery manufacturers and software and artificial intelligence developers more than it would benefit, say, real estate companies or wholesale merchants. According to the most recent National Science Foundation report, manufacturers perform over 50 percent of private domestic R&D, and information technology firms perform over a quarter of the R&D.

At the same time, though, investment in less capital- or R&D-intensive industries still matters. Investment drives productivity growth, and productivity growth drives wage growth for workers. Most workers work in the services sector today. Productivity growth matters for them as well. Only around 8 percent of the US private sector workforce works in manufacturing, and even a revival of manufacturing production should not substantially change the manufacturing employment share. To drive overall wage growth, we need investment across the board.

The America Forward tax credits are a notable change in direction for a campaign that has mostly focused on raising taxes on businesses. They also show a broader perspective than the Biden administration has had. But the idea stops short of the natural conclusion: that investment matters across the economy, and policymaking should reflect that.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share this article