In May 2024 I had the opportunity to participate in the California Lawyers Association Tax Section’s DC Delegation. Participants identify a tax rule in need of reform and draft a paper explaining why change is needed and offer proposals for that reform.

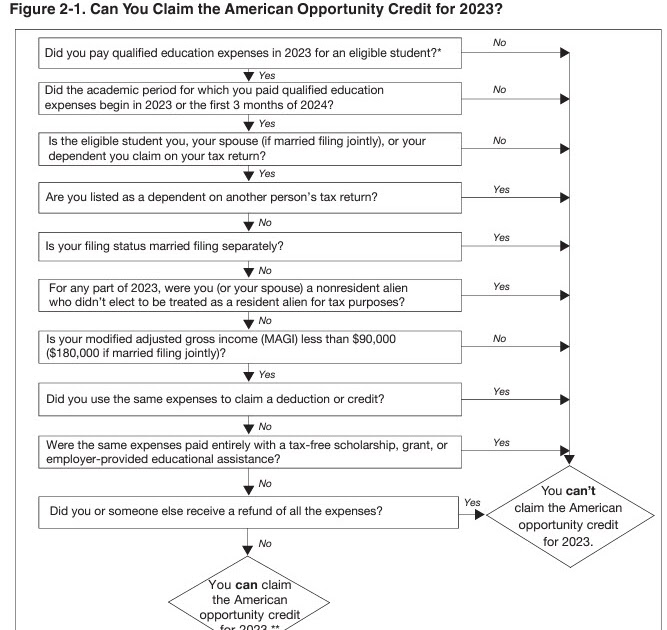

My May paper was on modifying and clarifying the American Opportunity Tax Credit (AOTC) which offers up to $10,000 of tax credit (subsidy) to most families for a child (or themselves) in the first four years of college ($2,500 maximum credit for year for up to four years).

The phaseout income levels for the credit are quite high so at least 80% of families qualify.

But there is a bit of unneeded confusion and complexity in the provision including exactly how the “first four years of college” are determined. An example on the IRS website makes it sound like you can select which of the four years of college count which seems out of sync with Code Section 25A (Q&A 16). But in sync if we are only required to ask if the student has reached “senior” status at the university. This basic issue should not be confusing, but is.

The IRS has an Interactive Tax Assistant tool on its website which can help but I found it might cause some users to give up such as asking if your spouse has an ITIN after answering “single” to the question about whether you are married.

There is also some complex planning possible if a student receives a scholarship, including a Pell Grant, that is partially taxable. One fix to help Pell Grant recipients has been proposed a few times but not enacted is to not require a Pell Grant recipient to reduce AOTC-eligible expenses by the amount of the grant.

For more background and my recommendations for both legislative and administrative improvements, see “Modify and Clarify the American Opportunity Tax Credit,” Tax Notes Federal, 9/26/24.

What do you think?