Over the past year, a lot of people have been talking about housing affordability and how tight it’s gotten. But just recently, there’s been a little bit of relief on that front. Mortgage rates have gone down since their most recent peak in October. But there’s more to being able to afford a home than just mortgage rates.

To really understand home affordability, you need to look at the combination of three important factors: mortgage rates, home prices, and wages. Let’s dive into the latest data on each one to see why affordability is improving.

1. Mortgage Rates

Mortgage rates have come down in recent months. And looking forward, most experts expect them to decline further over the course of the year. Jiayi Xu, an economist at Realtor.com, explains:

“While there could be some fluctuations in the path forward … the general expectation is that mortgage rates will continue to trend downward, as long as the economy continues to see progress on inflation.”

And even a small change in mortgage rates can have a big impact on your purchasing power, making it easier for you to afford the home you want by reducing your monthly mortgage payment.

2. Home Prices

The second important factor is home prices. After going up at a relatively normal pace last year, they’re expected to continue rising moderately in 2024. That’s because even with inventory projected to grow slightly this year, there still aren’t enough homes for sale for all the people who want to buy them. According to Lisa Sturtevant, Chief Economist at Bright MLS:

“More inventory will be generally offset by more buyers in the market. As a result, it is expected that, overall, the median home price in the U.S. will grow modestly . . .”

That’s great news for you because it means prices aren’t likely to skyrocket like they did during the pandemic. But it also means it’ll probably cost you more to wait. So, if you’re ready, willing, and able to buy, and you can find the right home, purchasing before more buyers enter the market and prices rise further might be in your best interest.

3. Wages

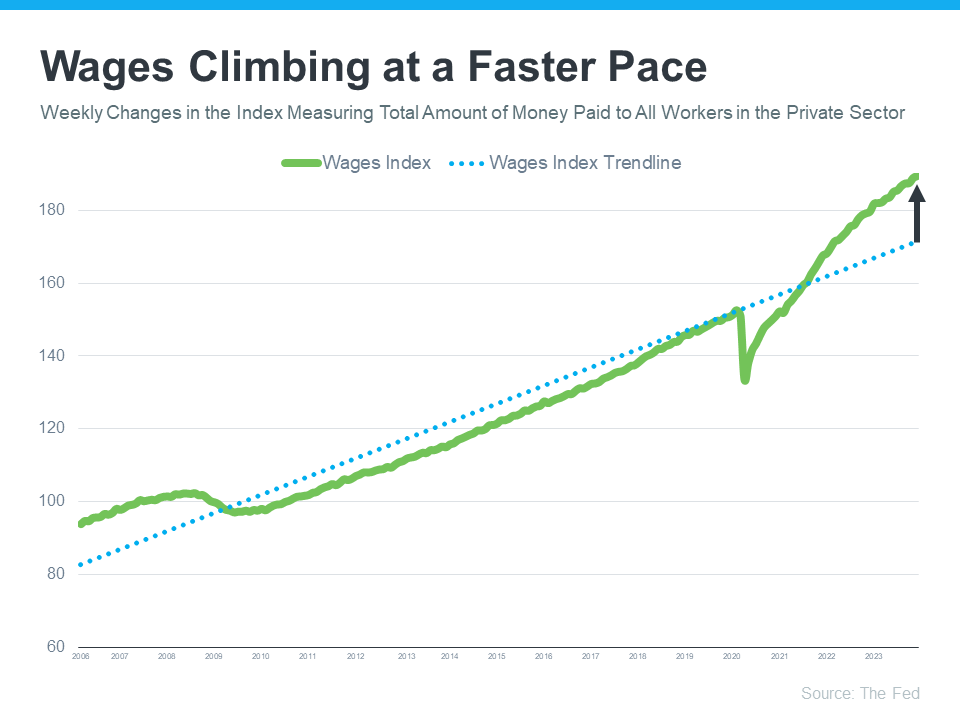

Another positive factor in affordability right now is rising income. The graph below uses data from the Federal Reserve to show how wages have grown over time:

If you look at the blue dotted trendline, you can see the rate at which wages typically rise. But on the right side of the graph, wages are above the trend line today, meaning they’re going up at a higher rate than normal.

Higher wages improve affordability because they reduce the percentage of your income it takes to pay your mortgage. That’s because you don’t have to put as much of your paycheck toward your monthly housing cost.

What This Means for You

Home affordability depends on three things: mortgage rates, home prices, and wages. The good news is, they’re moving in a positive direction for buyers overall.

If you’re thinking about buying a home, it’s important to know the main factors impacting affordability are improving. To get the latest updates on each, let’s connect.

Contact us for experienced representation when buying or selling property in the Bay Area.